Understanding cost accounting empowers businesses to make informed decisions; therefore, learning how to find total cost is crucial. Inventory valuation techniques, such as FIFO and LIFO, significantly influence reported costs. Activity-Based Costing (ABC), a method used by many management accountants, offers a more detailed breakdown of overhead allocation, leading to a more accurate assessment. Mastering how to find total cost enables you to analyze the true profitability of products and services.

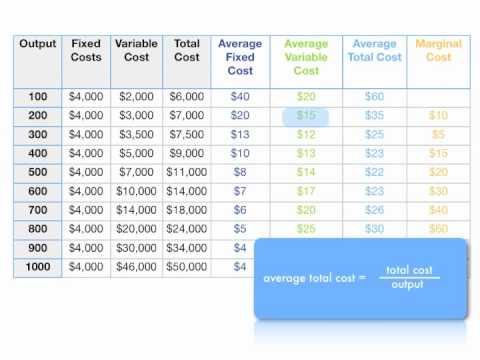

Image taken from the YouTube channel Economicsfun , from the video titled How to Calculate Total Cost, Marginal Cost, Average Variable Cost, and ATC .

In the realm of business and personal finance, few concepts are as critical as total cost. It’s more than just adding up expenses; it’s about understanding the complete financial picture associated with a decision, product, or service. Whether you’re a business owner setting prices or an individual managing a household budget, a clear grasp of total cost is essential for informed decision-making.

Why Knowing Total Cost Matters

For businesses, understanding the total cost is paramount. It directly impacts pricing strategies, profitability, and overall financial health. Accurately calculating total cost allows businesses to set competitive prices that cover all expenses while still generating a reasonable profit margin.

Ignoring certain cost components can lead to underpricing, resulting in losses even with high sales volumes. It also facilitates better budget control, investment decisions, and strategic planning.

Individuals also benefit significantly from understanding total cost. From buying a car to planning a vacation, knowing the true cost helps in making financially sound choices. It aids in effective budget management, avoiding unnecessary debt, and achieving long-term financial goals. Failing to consider all costs can lead to overspending and financial strain.

The Building Blocks of Total Cost

At its core, total cost is the sum of two primary components: fixed costs and variable costs.

-

Fixed Costs: These costs remain constant regardless of the level of production or activity. Examples include rent, salaries, insurance premiums, and loan payments. They are incurred even if there is no output.

-

Variable Costs: These costs fluctuate directly with the level of production or activity. Examples include raw materials, direct labor, sales commissions, and utilities. The more you produce, the higher the variable costs.

Understanding the distinction between these two types of costs is fundamental to accurately calculating the total cost.

Steps to Determining Total Cost: A High-Level View

Calculating the total cost involves a systematic approach. While the specific steps may vary depending on the context, the general process includes the following:

-

Identify All Relevant Costs: This involves creating a comprehensive list of all fixed and variable costs associated with the product, service, or decision.

-

Categorize Costs: Classify each cost as either fixed or variable.

-

Quantify Costs: Determine the amount of each cost component. This may involve tracking expenses, analyzing invoices, and making estimations.

-

Calculate Total Variable Costs: Multiply the variable cost per unit by the number of units produced or sold.

-

Calculate Total Cost: Add the total fixed costs and total variable costs.

These steps provide a framework for determining the total cost. Subsequent sections will delve into each of these steps in greater detail, providing practical examples and guidance.

Identifying Relevant Cost Entities: A Comprehensive List

Before diving into the actual calculations, it’s crucial to identify all the cost entities that contribute to the total cost in your specific scenario. This comprehensive list forms the foundation of an accurate total cost analysis. Let’s explore the various cost concepts, tools, relevant fields, and basic calculations involved.

Essential Cost Concepts

Understanding different cost concepts is essential for identifying all relevant expenses. Some concepts are relevant in all scenarios, while others are not.

Fixed Costs

Fixed costs are expenses that remain constant regardless of the level of production or activity.

These costs are incurred even if no goods are produced or services rendered.

Examples include rent, salaries, insurance premiums, property taxes, and loan payments.

Variable Costs

Variable costs, on the other hand, fluctuate directly with the level of production or activity.

The more you produce, the higher your variable costs will be.

Examples include raw materials, direct labor, sales commissions, and shipping costs.

Marginal Cost

Marginal cost is the additional cost incurred by producing one more unit of a good or service.

Understanding marginal cost is vital for making informed production decisions and optimizing profitability.

For example, if producing 100 units costs $1,000 and producing 101 units costs $1,009, the marginal cost is $9.

Average Cost

Average cost is the total cost divided by the number of units produced.

It provides a per-unit cost figure that can be useful for pricing and profitability analysis.

Average cost can be influenced by both fixed and variable costs.

Opportunity Cost

Opportunity cost represents the potential benefits you forgo when choosing one alternative over another.

It’s the value of the next best alternative.

For example, the opportunity cost of investing $10,000 in your business might be the return you could have earned by investing it in the stock market.

Direct Costs

Direct costs are expenses that can be directly traced to a specific product, service, or project.

Examples include the cost of raw materials used to manufacture a product or the wages of employees directly involved in providing a service.

Indirect Costs

Indirect costs, also known as overhead costs, are expenses that cannot be directly traced to a specific product, service, or project.

These costs benefit multiple activities.

Examples include rent for a factory building, utilities, and administrative salaries.

Cost Accounting

Cost accounting is a branch of accounting focused on measuring, analyzing, and reporting costs.

It provides valuable insights for decision-making, cost control, and performance evaluation.

Cost-Benefit Analysis

Cost-benefit analysis is a systematic approach to evaluating the pros and cons of a decision, project, or investment.

It compares the total costs with the expected benefits to determine whether an undertaking is worthwhile.

Pricing Strategies

Total cost is a critical factor in determining pricing strategies.

Businesses need to ensure that their prices cover all costs and generate a reasonable profit margin.

Common pricing strategies include cost-plus pricing, value-based pricing, and competitive pricing.

Break-Even Analysis

Break-even analysis determines the point at which total revenue equals total costs.

This analysis helps businesses understand the sales volume needed to cover all expenses and start generating a profit.

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods that a company sells.

It includes the cost of raw materials, direct labor, and manufacturing overhead.

COGS is a crucial metric for calculating gross profit and assessing profitability.

Economies of Scale

Economies of scale occur when a company’s average cost per unit decreases as production volume increases.

This is often due to factors such as increased efficiency, specialization, and bulk purchasing.

Cost Drivers

Cost drivers are the factors that influence or cause changes in costs.

Identifying cost drivers can help businesses understand and control their expenses more effectively.

Examples include labor hours, machine hours, and the number of customer orders.

Cost Allocation

Cost allocation is the process of distributing indirect costs to different products, services, or departments.

This helps provide a more accurate picture of the total cost associated with each activity.

Common allocation methods include activity-based costing and traditional allocation based on factors such as square footage or labor hours.

Useful Tools for Calculating Total Cost

Several tools can streamline the process of calculating total costs.

Spreadsheet Software

Spreadsheet software like Microsoft Excel and Google Sheets are versatile tools for data entry, calculations, and analysis.

You can use formulas and functions to automate calculations and create charts and graphs to visualize cost data.

Accounting Software

Accounting software such as QuickBooks and Xero offers comprehensive capabilities for cost tracking, reporting, and financial management.

These tools can automate many of the tasks involved in calculating total costs and provide valuable insights into your financial performance.

Cost Estimating Software

For complex projects with many variables, specialized cost estimating software can be invaluable.

These tools often incorporate advanced features such as Monte Carlo simulation and risk analysis.

Calculators

Don’t underestimate the basic necessity of a calculator for quick calculations and estimations.

Even with advanced software, a simple calculator is often handy for double-checking figures.

Relevant Organizations and Fields

Several fields rely heavily on total cost calculations.

Accounting

Accounting is the core field where total cost calculations are fundamental.

Cost accounting, in particular, focuses on measuring, analyzing, and reporting costs for decision-making purposes.

Finance

Finance applies total cost in financial analysis, investment decisions, and valuation.

Understanding total cost is essential for evaluating the profitability and feasibility of different financial opportunities.

Economics

Economics provides the theoretical framework for understanding costs and their impact on markets and resource allocation.

Concepts such as marginal cost and opportunity cost are central to economic analysis.

Business Management

Business management relies on total cost for practical applications in business operations.

This includes pricing, budgeting, cost control, and performance evaluation.

Cost Management

Cost management is a specialized area of expertise focused on planning, controlling, and reducing costs.

Cost managers use various techniques and tools to optimize resource utilization and improve profitability.

Basic Calculations Involved

While software can automate complex calculations, understanding the underlying mathematical operations is essential.

Addition

Addition is used to sum various cost components, such as fixed costs and variable costs, to arrive at the total cost.

Multiplication

Multiplication is used to calculate variable costs based on quantity, such as the cost of raw materials multiplied by the number of units produced.

Division

Division is used to calculate average costs, such as total cost divided by the number of units produced.

Percentage Calculation

Percentage calculation is used to determine markups and cost changes, such as calculating the percentage increase in raw material costs.

Having explored a comprehensive list of cost entities, from fixed overhead to subtle opportunity costs, the challenge now becomes discerning which costs truly matter for a particular calculation. Not all expenses are created equal; their relevance varies drastically depending on the situation at hand. Therefore, assigning a level of importance and filtering costs according to a well-defined criteria is a crucial step in ensuring the total cost analysis is both accurate and focused.

Assigning Proximity Scores and Filtering Relevant Entities

The devil, as they say, is in the details, and in total cost calculation, those details often lie in the proper identification and prioritization of expenses. To streamline this process, we introduce the concept of a "closeness rating," a subjective but systematic method for gauging the relevance of each cost entity to the specific scenario under consideration.

Understanding the Closeness Rating

A closeness rating, or relevance score, is essentially a numerical value assigned to each cost entity. This value reflects the degree to which that entity directly impacts the total cost being calculated.

A simple scale, such as 1-10, provides a clear framework. A score of 1 indicates minimal or no relevance, while a score of 10 signifies a direct and significant impact on the total cost.

The beauty of this system lies in its adaptability. The scale can be adjusted (e.g., 1-5, 1-100) to suit the complexity and granularity required by the specific analysis.

Guidelines for Assigning Closeness Ratings

The assignment of closeness ratings is not an arbitrary exercise; it requires careful consideration of the specific context of the total cost calculation. Here are some guidelines to ensure consistency and accuracy:

- Define the Scope: Clearly define the boundaries of the calculation. What are you trying to measure the total cost of? This provides a crucial filter for relevance.

- Consider the Direct Impact: Assess how directly the cost entity influences the outcome. Does it directly contribute to the production of goods, delivery of services, or achievement of the desired outcome?

- Evaluate the Magnitude: Even if a cost entity is directly related, its magnitude matters. A small, insignificant expense might receive a lower score than a larger, more impactful one.

- Document Your Reasoning: Maintain a record of the rationale behind each assigned score. This ensures transparency and allows for easy review and adjustments as needed.

For instance, when calculating the total cost of running a marketing campaign, advertising expenses would likely receive a high closeness rating (e.g., 9 or 10), while the cost of office supplies used by the marketing team might receive a lower rating (e.g., 3 or 4), as they are a more indirect cost.

Filtering with a Threshold Score

Once closeness ratings have been assigned, the next step is to establish a threshold score. This score acts as a filter, eliminating entities that are deemed insufficiently relevant to the calculation.

For example, you might decide to only consider entities with a score of 7 or higher. This means that any cost entity scoring below 7 would be excluded from the final total cost calculation.

The choice of threshold score depends on the desired level of accuracy and the complexity of the scenario. A higher threshold score will result in a more focused calculation, while a lower score will capture a wider range of potential costs.

It is important to evaluate which scores are too low to affect the outcome of the total cost calculation.

Context Matters: Business vs. Personal

The business or personal context significantly influences the assignment of proximity scores. In a business setting, profitability and efficiency are paramount, leading to a more stringent evaluation of cost entities. Expenses with a tenuous link to revenue generation might be assigned lower scores.

In contrast, personal finance decisions often involve a broader range of factors, including lifestyle choices and personal values. As a result, seemingly "unnecessary" expenses might receive higher scores if they contribute significantly to overall well-being.

For example, consider the cost of organic food. In a restaurant setting focused on maximizing profits, the higher cost of organic ingredients might receive a lower closeness rating if customers are unwilling to pay a premium.

However, in a personal budget focused on health and wellness, the same expense might receive a higher rating, reflecting the individual’s commitment to healthy eating.

By thoughtfully assigning proximity scores and filtering relevant entities, the total cost calculation becomes more focused, accurate, and ultimately, more useful for informed decision-making.

Having navigated the process of identifying and prioritizing cost entities, the next logical step is to translate this refined list into a tangible total cost figure. This section will demystify the core formula for calculating total cost and demonstrate its practical application across diverse scenarios, shedding light on potential complexities and real-world nuances along the way.

Calculating Total Cost: The Formula and Practical Application

The bedrock of total cost calculation rests upon a deceptively simple equation: Total Cost = Fixed Costs + Variable Costs. Understanding and applying this formula correctly, however, requires careful consideration of what constitutes each component and how they interact within a specific context.

Breaking Down the Total Cost Formula

At its core, the total cost formula is an additive relationship between fixed costs, those expenses that remain relatively constant regardless of production or service volume, and variable costs, which fluctuate directly with the level of activity.

Fixed Costs: These are the expenses a business or individual incurs regardless of their output. Think of rent, insurance premiums, or salaries for permanent staff. Even if a factory produces zero units in a month, it still owes rent.

Variable Costs: These costs change in direct proportion to the volume of goods or services produced. Raw materials, direct labor costs (hourly wages), and sales commissions are prime examples. The more you produce, the higher your variable costs will be.

Step-by-Step Examples Across Different Scenarios

To solidify the application of the total cost formula, let’s examine a few practical examples across different contexts:

Example 1: Manufacturing Scenario (Cost of Goods Sold – COGS)

Imagine a small furniture manufacturer. Their fixed costs per month include:

- Rent: \$2,000

- Equipment Depreciation: \$500

- Salaries (Administrative): \$3,000

- Total Fixed Costs: \$5,500

Their variable costs per unit of furniture produced are:

- Raw Materials (wood, fabric, etc.): \$50

- Direct Labor: \$30

- Packaging: \$5

- Total Variable Costs per Unit: \$85

If they produce 100 units of furniture in a month:

- Total Variable Costs = 100 Units

**\$85/Unit = \$8,500

- Total Cost = \$5,500 (Fixed Costs) + \$8,500 (Variable Costs) = \$14,000

- Cost Per Unit = \$14,000 / 100 Units = \$140

Example 2: Service-Based Business Scenario

Consider a freelance graphic designer. Their fixed costs per month might be:

- Software Subscriptions: \$200

- Website Hosting: \$50

- Marketing Expenses (Fixed): \$100

- Total Fixed Costs: \$350

Their variable costs are primarily related to the time spent on each project. Let’s assume they bill hourly:

- Hourly Rate (after considering expenses): \$50

If they work 50 hours on client projects in a month:

- Total Variable Costs = 50 Hours** \$50/Hour = \$2,500

- Total Cost = \$350 (Fixed Costs) + \$2,500 (Variable Costs) = \$2,850

Example 3: Personal Budget Scenario

An individual’s monthly fixed costs could include:

- Rent/Mortgage: \$1,500

- Car Payment: \$300

- Insurance: \$200

- Total Fixed Costs: \$2,000

Variable costs might be:

- Groceries: \$400 (varies depending on eating habits)

- Utilities: \$150 (varies with usage)

- Entertainment: \$100 (varies with social activities)

- Gasoline: \$100 (varies with driving distance)

- Total Variable Costs: \$750

Total Monthly Cost = \$2,000 (Fixed Costs) + \$750 (Variable Costs) = \$2,750

Accounting for Indirect Costs and Allocation

While the core formula focuses on direct costs, indirect costs (overhead expenses) also contribute to the overall cost structure. These are expenses that aren’t easily traceable to a specific product or service.

Examples of indirect costs include:

- Rent for a shared office space

- Utilities for the entire building

- Salaries of administrative staff

The key is to allocate these indirect costs to specific products or services using a reasonable basis, such as:

- Square footage occupied

- Direct labor hours

- Machine hours

For instance, if a department occupies 20% of the total office space, it might be allocated 20% of the total rent and utilities as its share of indirect costs. Accurate cost allocation provides a more realistic picture of the true cost of each product or service.

Addressing Complexities: Inflation, Discounts, and Taxes

Real-world scenarios often present complexities that require adjustments to the basic total cost formula.

Inflation: The increasing price of goods and services over time. When projecting costs into the future, it’s essential to factor in inflation rates to avoid underestimating expenses.

Discounts: Suppliers may offer discounts for bulk purchases or early payments. These discounts should be factored into variable cost calculations to reflect the actual cost of materials.

Taxes: Sales taxes, property taxes, and other taxes can significantly impact the total cost. These taxes should be included as part of the cost of goods or services.

By carefully considering these complexities and adjusting the total cost calculation accordingly, businesses and individuals can gain a more accurate and comprehensive understanding of their true expenses.

Utilizing Software for Efficient Total Cost Management

Having navigated the process of identifying and prioritizing cost entities, the next logical step is to translate this refined list into a tangible total cost figure. This section will demystify the core formula for calculating total cost and demonstrate its practical application across diverse scenarios, shedding light on potential complexities and real-world nuances along the way.

Modern software solutions offer powerful tools to streamline the traditionally cumbersome process of calculating and managing total costs. These tools enhance accuracy and efficiency while providing valuable insights that can inform strategic decision-making. From basic spreadsheet programs to sophisticated accounting platforms and specialized estimating software, the options are diverse and cater to different needs and levels of complexity.

The Power of Spreadsheets: Excel and Google Sheets

Spreadsheet software like Microsoft Excel and Google Sheets remains a cornerstone for cost calculation. Their versatility and widespread availability make them accessible tools for businesses of all sizes. While they may not offer the comprehensive features of dedicated accounting software, their flexibility allows for customized solutions tailored to specific needs.

Automating Calculations with Formulas and Functions

The real strength of spreadsheets lies in their ability to automate calculations through formulas and functions. Instead of manually crunching numbers, users can create dynamic models that automatically update as data changes.

Formulas enable basic mathematical operations like addition, subtraction, multiplication, and division. Functions offer more advanced capabilities, such as calculating averages, standard deviations, and even performing what-if analyses. By mastering these tools, you can significantly reduce the time and effort required to calculate total costs.

For instance, calculating the total cost of goods sold (COGS) can be simplified by creating a formula that sums the cost of raw materials, direct labor, and manufacturing overhead. As these input costs change, the total COGS will automatically update, providing real-time insights into profitability.

Visualizing Cost Data with Charts and Graphs

Beyond simple calculations, spreadsheets excel at visualizing cost data through charts and graphs. These visual representations can reveal trends, identify outliers, and highlight areas of concern.

For example, a line chart can track total costs over time, revealing whether costs are increasing, decreasing, or remaining stable. A pie chart can illustrate the proportion of total costs attributable to different categories, such as labor, materials, and overhead.

Visualizing your data is key to understanding it. These visual aids can help stakeholders quickly grasp complex information and make more informed decisions.

Accounting Software: A Comprehensive Approach

Accounting software, such as QuickBooks and Xero, takes cost management to the next level. These platforms offer a holistic suite of features designed to track, analyze, and report on financial data. While they may require a steeper learning curve than spreadsheets, the benefits are significant for businesses seeking comprehensive cost control.

Expense Tracking, Invoicing, and Reporting

Accounting software excels at tracking expenses. It allows you to categorize transactions, reconcile bank statements, and generate detailed reports on spending patterns. Robust expense tracking ensures all costs are accounted for, preventing leakage and improving accuracy.

Invoicing capabilities streamline the billing process. By integrating invoicing with expense tracking, you can easily calculate the cost of goods or services sold and determine profitability on a per-project or per-customer basis.

Moreover, accounting software provides a wealth of reporting tools. These reports can provide insights into total costs, profit margins, and other key performance indicators (KPIs).

Specialized Cost Estimating Software

For complex projects, specialized cost estimating software may be necessary. These programs provide advanced features for detailed cost breakdowns, risk analysis, and scenario planning.

They are particularly useful in industries such as construction, engineering, and manufacturing, where projects involve numerous variables and uncertainties. While these tools can be expensive and require specialized training, the accuracy and insights they provide can be invaluable for managing large, complex projects.

Having seen how to efficiently calculate total costs using software, the real power lies in understanding how to interpret and leverage this data. Total cost figures aren’t just numbers; they’re vital signs for your business or personal finances, offering insights that can drive smarter decisions.

Analyzing and Interpreting Total Cost Data: Making Informed Decisions

Total cost data, once meticulously calculated and readily accessible, transforms into a potent tool for strategic decision-making. Whether you’re setting prices, allocating budgets, or evaluating investments, understanding the story your cost data tells is paramount to success. This section dives deep into the analytical techniques and applications that unlock the true value of total cost information.

Pricing Strategies: Finding the Sweet Spot

One of the most direct applications of total cost data is in informing pricing strategies. A fundamental principle is that your price must, at a minimum, cover your total costs to ensure profitability and long-term sustainability.

Understanding your total cost allows you to determine the price floor, below which you’ll be operating at a loss.

However, pricing isn’t simply about covering costs. It’s about finding the optimal balance between profitability and competitiveness. Consider these points:

- Cost-Plus Pricing: A straightforward approach where a markup percentage is added to the total cost to arrive at the selling price. This ensures profitability but may not be optimal in highly competitive markets.

- Value-Based Pricing: This involves setting prices based on the perceived value of your product or service to the customer. While total cost serves as a baseline, market research and customer feedback are crucial for determining value.

- Competitive Pricing: Analyzing competitor pricing is essential. Understanding your total cost allows you to strategically undercut competitors while still maintaining profitability or to justify premium pricing based on superior value.

- Dynamic Pricing: The key to dynamic pricing is to adjust prices based on real-time factors, such as demand and competitor actions. Knowing your total costs is imperative to adjust prices accurately.

Budget Allocation and Resource Management: Spending Wisely

Total cost data is indispensable for effective budget allocation and resource management. By understanding the costs associated with different activities, departments, or projects, you can make informed decisions about where to allocate resources for maximum impact.

- Identifying Cost Drivers: Analyzing total cost allows you to pinpoint the factors that significantly impact your expenses. Focusing on managing these cost drivers can lead to substantial savings.

- Prioritizing Investments: When resources are limited, total cost data helps you prioritize investments with the highest return. By comparing the potential benefits of different projects against their total costs, you can make informed decisions about which ones to pursue.

- Optimizing Resource Utilization: Understanding the total cost associated with different resources (e.g., labor, equipment, materials) allows you to optimize their utilization. This might involve streamlining processes, renegotiating contracts, or investing in more efficient technologies.

- Performance Measurement: Track your budgeted vs. actual costs to monitor the true costs associated with activities in your organization to ensure your organization is maintaining operational efficiencies.

Cost-Benefit Analysis: Evaluating Investment Opportunities

Cost-benefit analysis is a powerful tool for evaluating investment opportunities. It involves comparing the total costs of an investment with its expected benefits, expressed in monetary terms. Total cost data is a critical input into this analysis.

- Calculating Return on Investment (ROI): ROI measures the profitability of an investment relative to its cost. Accurate total cost data is essential for calculating ROI and comparing different investment options.

- Net Present Value (NPV): NPV discounts future cash flows to their present value, taking into account the time value of money. Understanding the total cost of an investment over its lifespan is crucial for calculating NPV and determining its economic viability.

- Payback Period: The payback period measures the time it takes for an investment to generate enough cash flow to recover its initial cost. Total cost data helps determine the initial investment and predict future cash flows, essential in determining the payback period.

- Qualitative Factors: While cost-benefit analysis focuses on quantifiable data, it’s important to consider qualitative factors as well (e.g., brand reputation, environmental impact). Total cost data provides a solid foundation for decision-making, but qualitative factors can influence the final choice.

Monitoring Total Cost Over Time: Identifying Trends and Areas for Improvement

Regularly monitoring total cost over time is essential for identifying trends and areas for improvement. This involves tracking costs on a monthly, quarterly, or annual basis and comparing them to previous periods.

- Identifying Cost Increases: Tracking total cost allows you to quickly identify unexpected cost increases. Investigating the root cause of these increases can help you take corrective action before they significantly impact your profitability.

- Measuring the Impact of Cost-Cutting Measures: Implementing cost-cutting measures is only effective if you can measure their impact. Monitoring total cost over time allows you to assess the effectiveness of these measures and make adjustments as needed.

- Benchmarking Against Industry Standards: Comparing your total cost to industry benchmarks can provide valuable insights into your relative performance. If your costs are significantly higher than average, it may indicate areas where you can improve efficiency.

- Forecasting Future Costs: By analyzing historical cost data, you can develop forecasts for future costs. This can help you anticipate potential challenges and make proactive decisions to mitigate their impact.

FAQs: Mastering Total Cost Calculation

Here are some frequently asked questions about calculating the total cost, helping you master this essential skill.

What exactly is included when calculating total cost?

Total cost encompasses all expenses involved in producing a good or service. This includes both fixed costs, like rent, and variable costs, which fluctuate with production volume, such as materials and labor. Understanding all these components is crucial to knowing how to find total cost.

How do fixed costs impact the total cost calculation?

Fixed costs remain constant regardless of production levels. While not directly tied to each unit produced, they are a part of the overall expense. Therefore, when figuring out how to find total cost, you need to account for these expenses regardless of how many items are made.

What’s the difference between direct and indirect costs in the total cost?

Direct costs are easily traceable to a specific product or service (e.g., raw materials). Indirect costs, like utilities, support the overall production but aren’t directly linked to a single item. You’ll need to factor in both to understand how to find total cost accurately.

Why is calculating total cost important for my business?

Knowing your total cost helps in setting appropriate pricing, determining profitability, and making informed business decisions. Without accurately knowing how to find total cost, you risk underpricing your product, reducing profits, or making poor business strategies.

So, now you’re equipped to tackle the challenge! Go ahead and apply these principles to how to find total cost in your own projects and situations. Best of luck, and thanks for diving in!